Table of Contents

Strong buy signals for stocks for next week!! Here are the 5 best stocks to buy today in India for the short term.

Introduction

With a focus on short- to medium-term market swings within longer trends, it involves buying and holding positions for a few days to several weeks. Based on their technical analysis, these are some of the best trending stocks for swing trading and frequently provide adequate opportunities all month long. Please note that these stocks are updated weekly and are only available for long trades. Technical analysis is the only factor considered when choosing trending stocks.

Market Sentiment

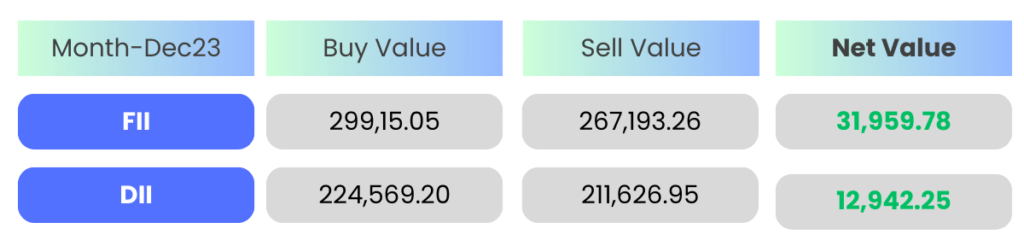

We must first examine the indices. Both the Nifty 50 and Bank Nifty are above all moving averages and remain bullish. It appears that the market sentiment is positive, and traders should continue to adhere to a buy-on-dips approach. Additionally, the data for net purchase/sale statistics for both domestic and foreign institutional investors (FII and DII, respectively) is shown below. These results strongly indicate a bullish market outlook.

5 trending Stocks

For the upcoming week, these are the top 5 trending stocks. Additionally, check out each stock’s comprehensive technical analysis below.

Berger Paints India Limited (BERGEPAINT)

Based in Kolkata, India, Berger Paints Ltd. is a multinational paint company. The company was founded in 1923. This company operates sixteen production facilities in India. The business is present in Bangladesh, Nepal, Poland, Russia, and India. It employs more than 3,600 people and has more than 25,000 dealers in its nationwide distribution network.This stock is among the best stocks to buy for this week.

As per chart analysis, we can clearly see price-taking support on 8 MA and on 21 MA in the monthly chart and weekly chart, respectively. The strong green candle bar also signals the price to be in an uptrend for a few weeks.

- Action: BUY

- Target 1: Rs 619.5

- Target 2: Rs 645

- Stop Loss: Rs 588

- Holding Period: 2-3 weeks

- Time Framed: Weekly/Monthly

Hatsun Agro Product Limited (HATSUN)

With its main office in Chennai, Tamil Nadu, Hatsun Agro Product Ltd. (HAP), sometimes known as Hatsun (HAP), is one of India’s top dairy companies in the private sector. Founded in 1970 by R. G. Chandramogan, Additionally, the business was named “The Fastest-Growing Asian Dairy Company.” The Indian government has been awarding the Golden Trophy to the top dairy exporter for many years to the manufacturer of dairy products. Hatsun is also one of the best stocks to buy for trending stocks this week.

As per chart analysis, we can clearly see price-taking support on 8 MA in the monthly chart and weekly chart, respectively. The price is crossing 21 MA in the weekly chart. A strong green candle bar also signals strong movement to come.

- Action: BUY

- Target 1: Rs 1182

- Target 2: Rs 1233

- Stop Loss: Rs 1102

- Holding Period: 2-3 weeks

- Time Framed: Weekly/Monthly

Divi's Laboratories Limited (DIVISLAB)

Divi’s Laboratories Limited, with its headquarters located in Hyderabad, is an Indian multinational pharmaceutical firm that produces intermediates and active pharmaceutical ingredients (APIs). The company was founded in 1990 by Murali Krishna Prasad Divi. The business produces and creates custom intermediates and generic APIs. Through its subsidiary, Divi’s Nutraceuticals, the business also produces and distributes nutraceutical ingredients. Based on market capitalization, Divi’s Laboratories is the fourth-biggest pharmaceutical firm in India that is publicly traded. DIVISLAB is the also one of the best stocks to buy for trending stocks for upcoming weeks.

As per chart analysis, we can clearly see price-taking support on 8 MA in the weekly chart, and in the monthly chart, price-taking support on 21 MA and 8 MA has bounced up. A strong green candle bar also signals strong movement.

- Action: BUY

- Target 1: Rs 4032

- Target 2: Rs 4094

- Stop Loss: Rs 3800

- Holding Period: 2-3 weeks

- Time Framed: Weekly/Monthly

vardhana Motherson International Limited (MOTHERSON)

MOTHERSON (formerly known as Motherson Sumi Systems Ltd.) is an Indian multinational company that produces automobile components. It produces plastic parts, wire harnesses, and rearview mirrors for passenger cars. The company was founded in 1986 as a joint venture with the Japanese Sumitomo Group. MOTHERSON is one of the stocks that has a good setup for the best stocks to buy for trending stocks in the coming weeks.

As per chart analysis, we can clearly see price-taking support on 8 MA in the monthly chart and on 21 MA in the weekly chart; the price is ready to cross 100 MA in the monthly chart. Also, price has crossed 200 MA in the weekly chart. A strong green candle bar also signals strong movement.

- Action: BUY

- Target 1: Rs 106.5

- Target 2: Rs 115

- Stop Loss: Rs 100

- Holding Period: 1-2 weeks

- Time Framed: Weekly/Monthly

Kansai Nerolac Paints Limited (KANSAINER)

Based in Mumbai, Kansai Nerolac Paints Limited (previously Goodlass Nerolac Paints Ltd) is India’s largest industrial paint manufacturer and its third-largest decorative paint firm. It is a division of the Japanese paint manufacturer Kansai Paint. In the Indian paint business as of 2015, it holds the third-largest market share with 15.4%. It works in the automotive, industrial, and powder coating industries. It creates and provides paint solutions for use on the finishing lines of the furniture, bus bodies, bike, material management, and electrical component sectors.

As per chart analysis, we can clearly see price-taking support on 8 MA in the monthly chart and on 21 MA in the weekly chart; the price is ready to cross 100 MA in the monthly chart. Also, price has crossed 200 MA in the weekly chart. A strong green candle bar also signals strong movement.

- Action: BUY

- Target 1: Rs 344.5

- Target 2: Rs 358

- Stop Loss: Rs 327

- Holding Period: 1-2 weeks

- Time Framed: Weekly/Monthly

Conclusion

According to technical analysis, these five stocks have a strong setup and are the best stocks to buy for trending stocks in the coming week. Capturing the swings within the broader trend is our aim as swing traders. Furthermore, it should be understood that trading is a speculative activity and that effective risk management, including the use of stop losses, is necessary to guard against large losses. Additionally, the majority of top stock brokers in India offer margin trading and MTF trading options if you are struggling with a lack of funds.

Disclaimer: This article about finance and investments contains material solely for educational purposes. It does not constitute investment advice. While we try to be accurate, we cannot guarantee that the information is appropriate or full. It is recommended that readers get advice from a licensed financial expert prior to making any investing decisions.

Related Posts

What is Swing Trading? A Beginners Guide to Swing Trading.

Image Source: Canva Table of Contents If you’re new to

TATA Upcoming IPO 2024 | Get Ready to Apply Soon!

(Image Source: Canva) Table of Contents Want to invest in

IREDA Share Price | Analysis & Targets 2024-2030

(Image Source: Canva) Table of Contents “Curious about IREDA’s stock

Porinju Veliyath-Investor | Investing Brilliance Decoded

Table of Contents “Wondering how Porinju Veliyath achieves investing brilliance?

Ashish Kacholia-Investor | Visionary Approach, Solid Returns.

Table of Contents “Who is Ashish Kacholia? Discover the secrets

Zerodha vs Upstox | Find out how Zerodha stacks up against Upstox

(Image Source: Canva) Table of Contents Are you worried and