(Image Source: Canva)

Table of Contents

“Discover the power of leveraging your investments, gaining increased market exposure, and possibly boosting returns. Start MTF trading today and redefine your investment journey!”

This article explores the details of MTF trading, shedding light on its advantages, disadvantages, and regulatory frameworks. Margin Trading Facility has emerged as a powerful financial tool in the Indian markets. The margin trading facility (MTF) has become very popular in recent years, with aspiring traders hoping to profit from changes in the market.

Introduction: Understanding MTF Trading

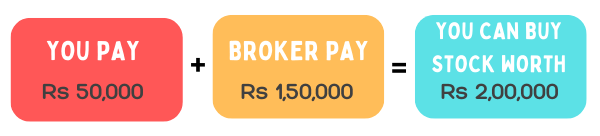

Borrowing money to enhance the amount of an investment is known as margin trading or margin trading facility. Traders, by utilizing their existing capital as leverage, could buy more shares than they could with their capital alone would allow. Or, in simple words, traders can just pay the initial margin, and the broker will fund the remaining margin. For example:

Advantages and Disadvantages of MTF Trading:

As you know now about MTF trading, let’s look at some of its advantages and disadvantages that every trader must be aware of before using margin trading facility for their trades.

MTF Advantages

- Increased buying power: Margin trading increases your buying power maximum up to 5x times the available capital. This can help traders expand their investment by buying more shares than their existing capital alone would. Thus increasing profit potential.

- Diversifying Portfolio: One of the fundamental principles of investing is diversifying. Margin Trading Facility helps reduce risk. Traders can buy more shares across various industries, thus increasing their portfolio performance and reducing the risk as well.

- Liquidity: With the margin trading facility, you can increase liquidity, which helps you capitalize on market opportunities and ensure timely execution, which is beneficial in trending markets or short-term swing trading. It frees traders minds from worrying about having limited funds.

MTF Disadvantages

- Magnified Losses: Margin trading helps traders increase their profits, but they may also increase their losses if the trade goes completely wrong. Traders could accumulate huge losses due to their increased exposure. Thus, leverage acts like a double-edged sword, as it can increase profits and losses with the same intensity.

- Liquidation Risk: This is the most common risk with margin trading facility. Traders always need to maintain a minimum balance in their trading account. If the balance decreases, the broker may issue a margin call and ask to quickly add funds; if not, the broker will square off the position to get back the borrowed funds.

- Interest Cost: Borrowing funds for margin trading requires some extra cost (interest); these interest costs could range from 4% to 20%, depending on the broking companies. Traders must carefully consider these costs, as they can add up if used too frequently or holding for extended period of time.

Placing (Margin Trading Facility) MTF trade

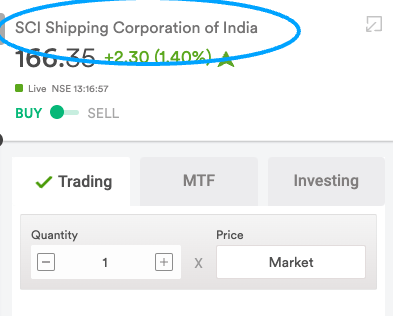

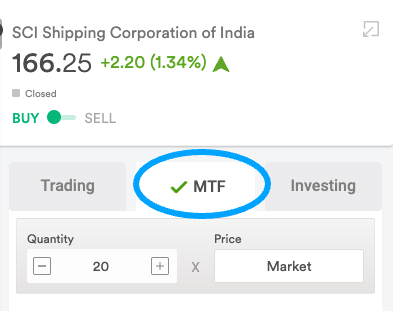

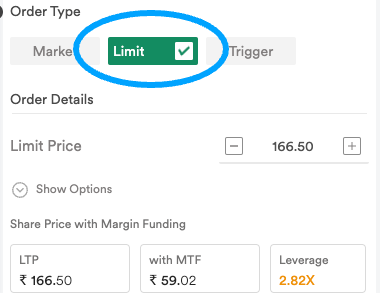

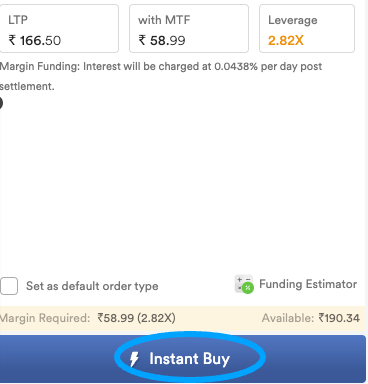

1.Select the preferred stock and open the order page to buy.

2.Make sure to select the MTF category and enter the quantity of stocks to buy.

3.Select the order type ( Market, Limit or Trigger).

4.Review your order again and click on buy to place the order.

SEBI Regulatory Framework for Margin Trading facility

Margin trading facility is regulated by the Securities and Exchange Board of India (SEBI) through strict guidelines. In the margin trading industry, SEBI seeks to maintain fair processes, transparency, and investor safety. SEBI has set some eligibility criteria for stocks eligible for margin trading. These requirements consist of market capitalization, liquidity, and a history of compliance with listing requirements.

What are the best brokers that provide MTF trading?

Some of the best and most popular brokers’ proving margin trading facility ( MTF) are as follows:

- DHAN

- UPSTOX

- ANGLEONE

- MSTOCK

- RUPEEZY

- GROWW

Bottom Line

Margin trading facilities are great tools for traders and provide an avenue for increased market involvement, but they are not without risk. Traders must approach margin trading with caution, understand the complexities involved, and put strong risk management techniques into place. This includes setting stop-loss orders to limit potential losses and diversifying positions to spread risk. Market participants must be informed about market developments and adapt their strategies accordingly as the regulatory framework evolves.

FAQ's for Margin Trading Facility (MTF)

Interest charges for availing of the margin trading facility (MTF) range from 4% to 20% per annum, depending on the broking companies.

As per SEBI guidelines, it is mandatory to pledge stocks that are bought in the margin trading facility (MTF) category. After the market closes, CDSL or NSDL sends the link to the trader.

If you forget or don’t pledge the stocks under margin trading facility (MTF) within the required time, then the broker will square off the position.

You can hold stocks as long as you wish, but you need to be aware of all the charges under margin trading facility (MTF).

Rupeezy provides the lowest interest rate at 3.99% for margin trading for MTF funding amounts up to Rs. 1 lakh. Note: (Rupeezy was originally known as AsthaTrade.)

Disclaimer: This article about finance and investments contains material solely for educational purposes. It does not constitute investment advice. While we try to be accurate, we cannot guarantee that the information is appropriate or full. It is recommended that readers get advice from a licensed financial expert prior to making any investing decisions.

video Tutorial for MTF Trading-English

Buy Stocks Pay Later (MTF) orders allow you to buy shares on margin, which means you can increase your purchasing power by borrowing money. In this video, we will demonstrate how to place a Buy Stocks, Pay Later (MTF) order on HDFC SKY.

video Tutorial for MTF Trading-Hindi

In this video, you’ll learn how leverage works in the stock market using MTF. With Dhan’s Margin Trading Facility (MTF), you get a 4X margin on 950+ stocks, which means Dhan pays up to 75% of your trades while you pay only 25%.

Related Posts

What is Swing Trading? A Beginners Guide to Swing Trading.

Image Source: Canva Table of Contents If you’re new to the whole

TATA Upcoming IPO 2024 | Get Ready to Apply Soon!

(Image Source: Canva) Table of Contents Want to invest in Tata Group

IREDA Share Price | Analysis & Targets 2024-2030

(Image Source: Canva) Table of Contents “Curious about IREDA’s stock performance? Discover

Porinju Veliyath-Investor | Investing Brilliance Decoded

Table of Contents “Wondering how Porinju Veliyath achieves investing brilliance? What are

Ashish Kacholia-Investor | Visionary Approach, Solid Returns.

Table of Contents “Who is Ashish Kacholia? Discover the secrets behind his

Zerodha vs Upstox | Find out how Zerodha stacks up against Upstox

(Image Source: Canva) Table of Contents Are you worried and curious about