(Image Source: Canva)

Table of Contents

Want to invest in Tata Group stocks? Following the successful IPO of Tata Technologies, the Tata group plans to launch further IPOs in the near future.

5 TATA Upcoming IPOs

Although current Tata stocks may appear costly to certain investors, there is promising news on board. The TATA group intends to introduce five new companies to the stock market via Initial Public Offerings (IPOs) in 2024.

These TATA upcoming IPOs include a wide range of businesses, providing an opportunity for early investment in the Tata conglomerate for interested individuals.

Here is a list of five Tata Upcoming IPOs that are set to open this year.

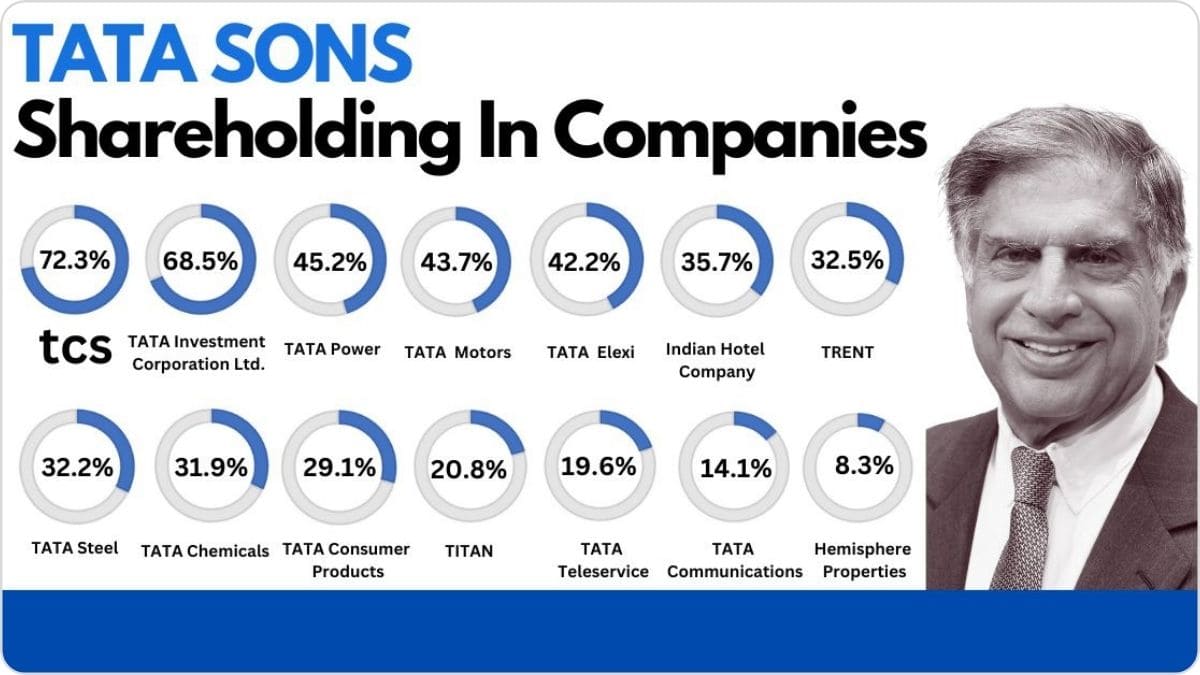

TATA Sons

(Data Source: Trendlyne)

First on the list for TATA upcoming IPOs.

Tata Sons, Tata Group’s parent business, will also go public. Tata Sons needs to list its shares by September 2025 after the RBI designated it as an ‘upper-layer’ NBFC last year. When a company is recognized as an upper-layer non-banking financial company (NBFC), the Reserve Bank of India mandates that it must go public within three years of receiving the status.

The Tata Group is comprised of more than one hundred companies that are actively operating in seven different business sectors. These sectors include engineering, materials, services, energy, consumer products, and chemicals. The TATA Sons IPO may be India’s largest TATA Upcoming IPO, coming later this year or by next year.

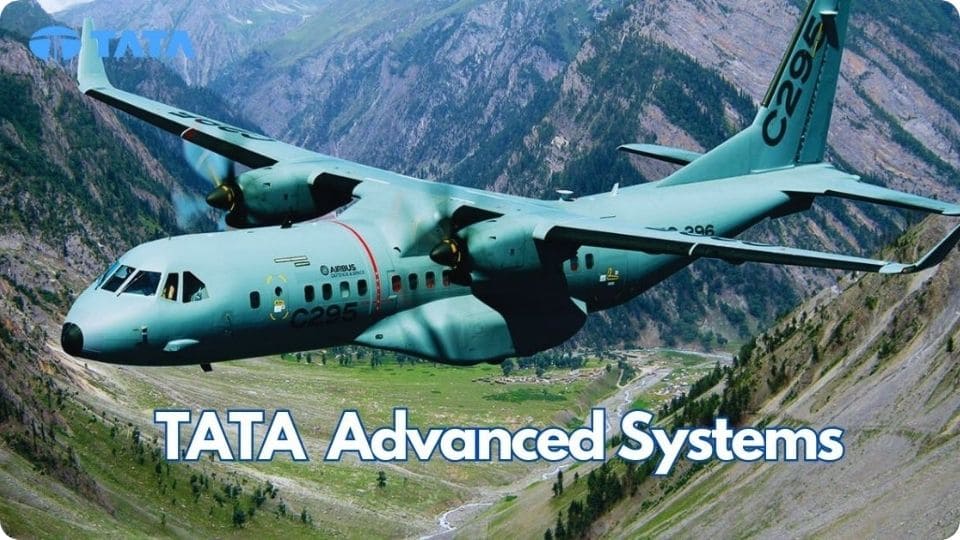

TATA Advanced Systems

(Image Source: tataadvancedsystems.com)

Tata Advanced Systems Limited (TASL), a wholly-owned subsidiary of Tata Sons, is the TATA Group’s aerospace and defense branch. It was established in 2007. It provides services in aerostructures, aero engines, airborne platforms, systems, defense, security, and land mobility. Tata Motors initially owned TASL as a subsidiary of its defense business; however, the company subsequently dissolved the defense business, and Tata Sons now owns TASL directly.

Tata Advanced Systems Limited (TASL) has built new weaponry and expanded the supply chain with Airbus to improve India’s defense. They’re even working with Satellogic to build India’s space technology. Tata Advanced Systems Limited (TASL) is a key player in the international supply chain and a global single-source provider for leading military OEMs due to its strong alliances and joint ventures with aerospace and defense companies. Tata Advanced Systems Limited (TASL) is one of the most anticipated TATA upcoming IPOs this year.

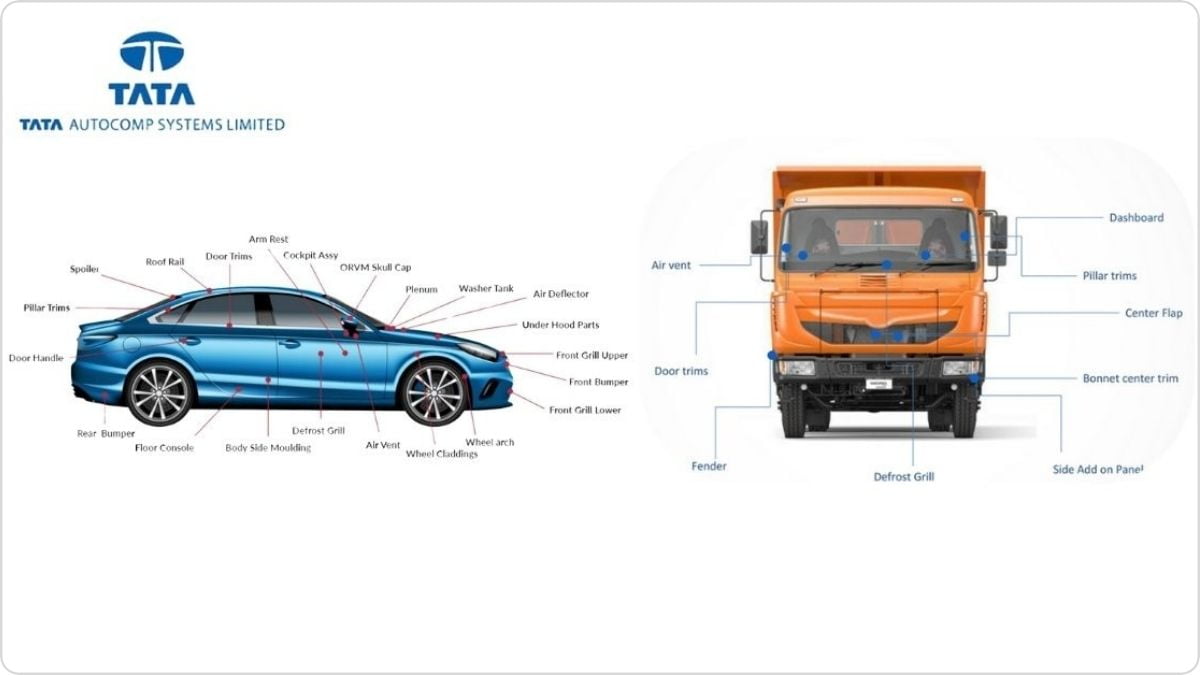

TATA Autocomp Systems

Third on the list for TATA upcoming IPOs.

Tata Group companies own all of TATA Autocomp Systems (TACO), with Tata Sons holding about 21% and Tata Industries Ltd. holding the remainder. TATA Autocomp Systems (TACO) was established in 1995 to oversee the group’s activities in the auto component industry.

Tata AutoComp Systems Limited serves Indian and global automotive OEMs and Tier 1 suppliers. Automotive interior and exterior plastics, composites, sheet metal stampings, engineering, and supply chain services are some of the products and services that TATA Autocomp Systems provides.

TATA Autocomp Systems (TACO) manufactures and markets engine cooling solutions, automotive batteries, rear view mirrors, command systems, HVAC, exhaust and emission control systems, seating systems, battery packs, battery cooling systems, battery management systems, motors, controllers, and integrated drivetrains.

Tata AutoComp Systems sells aftermarket parts and exports them to Europe, the US, the Middle East, and other nations. Tata AutoComp has 51 factories across India, North America, Latin America, Europe, and China.

Big Basket

Fourth on the list for TATA upcoming IPOs.

BigBasket is a Bangalore-based online retailer owned by Tata Digital. The first Indian online grocery opened in 2011. The company is officially registered as Supermarket Grocery Supplies Pvt. Ltd. In May 2021, Tata Group’s Tata Digital division bought a 64% majority stake in BigBasket, making Tata Group the owner of the company. BigBasket received a $200 million investment in January 2023 from investors, with Tata Digital being the biggest shareholder, resulting in the company’s valuation increasing to $3.2 billion.

The company serves over 30 Indian cities and processes 15 million orders each month as of January 2023. Bloomberg reports that BigBasket may go public by 2024–25 as part of its development aspirations.

TATA Play

Last on the list for TATA upcoming IPOs.

Tata Play, previously known as Tata Sky, is preparing to launch its initial public offering (IPO) this year. In the direct-to-home (DTH) market, Tata Play is among the front-runners and has a market share of around 32.5%.

Following three unsuccessful attempts in 2013, 2016, and 2019, Tata Sons and The Walt Disney Company India have finally decided to launch the company’s initial public offering (IPO). SEBI has already approved the IPO. The timetable and specifics of the IPO are yet undetermined, but it is anticipated to occur this year.

Conclusion

The Indian stock market has set several new highs in the first two months of 2024, which is a good start to the year. Although the launch dates and offer prices are still unknown, the Tata company has a history of rewarding shareholders and being dedicated to their growth ambitions. However, the main risk associated with every IPO is its valuations, and one should carefully consider this before deciding to invest in the upcoming TATA IPO companies.

Disclaimer: This article about finance and investments contains material solely for educational purposes. It does not constitute investment advice. While we try to be accurate, we cannot guarantee that the information is appropriate or full. It is recommended that readers get advice from a licensed financial expert prior to making any investing decisions.

Related Posts

Anant Ambani Watch Collection | Glimpse Into Luxury

Image Source: Canva/Instagram/Anant Ambani Table of Contents Anant Ambani, the

Yousta | Youth Focused Fashion Brand by Isha Ambani

Image Source: Canva/Instagram/Isha Ambani Table of Contents In the ever-changing

Yotta Data Services Buys 16,000 NVIDIA H100 Chips

Image Source: Canva Table of Contents Yotta Data Services Private

Elon Musk’s plans to bring Tesla to India in 2024

Image Source: Unsplash/Tesla Fans Schweiz Table of Contents Elon Musk

What is Swing Trading? A Beginners Guide to Swing Trading.

Image Source: Canva Table of Contents If you’re new to

Namita Thapar | Entrepreneur, Business Women & Angel Investor

Table of Contents Who is Namita Thapar? Discover the story